Every year, we assemble our W-2 forms, expense receipts, and more in preparation to file our taxes.

Some of us prepare our returns without fully understanding how exactly we’re supposed to file our personal taxes. And those of us who do try to understand how to file them properly end up sifting through 100+ pages of instructions before doing what we can and hoping for the best.

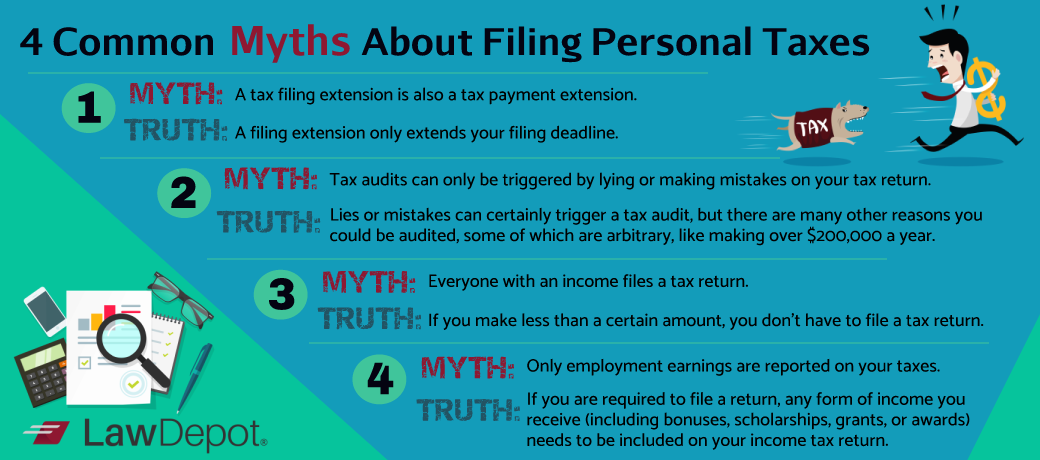

In this post, we debunk four common misconceptions about filing personal taxes and answer questions like what is a filing extension, what triggers audits, who files taxes, and what income is reported in your tax return.

Myth 1: A tax filing extension is also a payment extension

A common misconception is that a filing extension also gives you more time to pay any taxes you may be owing. However, this is untrue. Your payment, which can be steep if you pay all your taxes in April as opposed to with your paychecks, is due, in full, no extensions.

If you’re not ready to file your taxes by the mid-April deadline, you can submit a request to the Internal Revenue Service, also called the IRS, and ask for a filing extension for your tax return. With an extension, you have an extra few months to collect your receipts and income statements without incurring any sort of filing penalty.

That said, this filing extension is just that—an extension to file. Nothing more.

So, if you apply for a filing extension, save the trivial details (like copying receipts or printing spreadsheets) for later. Instead, pull out your calculator early and start preparing an estimated total using the IRS’s Instructions for 1040 tax table. Once the IRS receives your tax papers a few months later, this amount will be formally calculated and adjusted, if required.

Myth 2: Tax audits can only be triggered by lying or making mistakes

Though lying or mistakes can trigger an audit, it is not the only reason the IRS would consider auditing your income report.

For instance, the IRS may audit people who break reporting requirements (like those who unknowingly do not comply with the Foreign Account Tax Compliance Act) or people with hefty yearly salaries (like those who make over $200,000 per year).

When the IRS looks at returns, they typically compare your information to statistical norms and then flag irregularities for further review. Things like improperly reporting your income or falsifying personal expenses as business expenses (like claiming a dinner date with your spouse as lunch with a client) are definite red flags.

You can certainly sidestep some audits by remaining truthful and avoiding inaccuracies. However, some audits are inescapable. You can, at the very least, avoid any repercussions from getting audited by filling out your tax return precisely and properly.

The more documents you need to include with your taxes, the more difficult filing your taxes can be (and likewise, the more difficult it can be to avoid making mistakes).

However, outlining your worth in a Personal Financial Statement can help you sort out your financial affairs and hopefully mitigate any audits caused by slipups.

Myth 3: Everyone with an income files a tax return

Many of us assume that taxes are mandatory for all Americans with an income, but in reality, they’re not.

When it comes to personal taxes, those of us who make under a certain amount per year are not required to file an income tax return.

That said, even if you don’t technically need to file a tax return, the IRS recommends doing so anyway in order to be eligible for a potential refund or any credits (like the additional child tax credit, earned income credit, American opportunity credit, etc.).

If you’re unsure about whether you’re required to file taxes or not, consult the IRS’s 1040 filing instructions.

Myth 4: Only employment earnings are reported on your taxes

Supplemental wages (like vacation pay, bonuses, commission, etc.) and additional income (such as scholarships or grants) are usually included with your wages, tips, and other compensations.

Keep in mind that there may be some exceptions (for instance, some scholarships or grants may be nontaxable).

The IRS’s Interactive Tax Assistant (a responsive tool that calculates whether your additional income is taxable or nontaxable) can be used to find out what information you need to include on your return.

Preparing to File Your Personal Taxes

Every year, many of us file our taxes how we did the year before or the way we’ve been taught in school or at home. Unfortunately, this could mean some of us are unaware of misunderstandings or misinterpretations that cloud our ability to prepare and submit our taxes correctly.

By shedding some light on the most common tax myths, we hope you have a better grasp of personal tax filing, including extensions, audits, and reportable incomes.